Semi CapEx to Hit $152 Billion in 2021 as Market on Track for $2 Trillion by 2035

by Anton Shilov on December 17, 2021 11:00 AM ESTSemiconductor makers have drastically increased their capital expenditures (CapEx) this year in response to unprecedented demand for chips that is going to last for years. Now the CEO of Mubadala, the main stockholder of GlobalFoundries, is expecting sales of semiconductors to grow exponentially, toppling a whopping $2 trillion by mid-2030s.

“It took 50 years for the semiconductor business to turn into a half a trillion-dollar business," said Khaldoon Al Mubarak, CEO of Mubadala, in an interview with CNBC. "It is going to take probably eight to 10 years to double [by 2030 ~ 2031]. And it is going to double right after that, probably in four to five years.

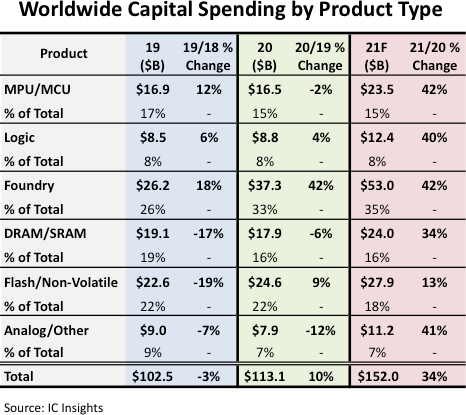

Chipmakers are on track to spend $152 billion on new fabs and production equipment this year, up from $113.1 billion last year. On percentage basis, this is a 34% increase year-over-year, which is the strongest YoY growth since 2017 when cumulative CapEx of semiconductor companies increased by 41% per annum, IC Insights reports.

![]()

Contract fabs like TSMC, Samsung Foundry, and GlobalFoundries will lead the whole industry in terms of CapEx spending, as they will pour in $53 billion in new fabs and equipment (35% of all semiconductor capital spending in 2021).

TSMC, the world's largest foundry, intended to spend between $25 billion and $35 billion on new manufacturing capacities as demand for its services is setting records. Furthermore, the company is preparing to ramp up production of chips using its N3 (3 nm) fabrication technology in 2023 and then N2 (2 nm) node in 2025, which requires buying new tools and building new fabs.

IC Insights expects TSMC to be the CapEx champion among all contract makers of chips this year followed by Samsung Foundry. By contrast, SMIC had to cut down its 2021 CapEx to $4.3 billion since it is extremely hard for a company in the U.S. Bureau of Industry and Security's Entity List to procure tools from U.S.-based companies like Applied Materials, KLA, or Lam Research. GlobalFoundries also initiated expansion of production capacities in Germany, Singapore, and the U.S.

Meanwhile memory and flash manufacturers are expected to spend $51.9 billion on new fabs and production equipment this year. Since usage of NAND memory is increasing, spending on new flash production capacities is forecasted to reach $27.9 billion, whereas investments in DRAM production will total $24 billion. Interestingly, but CapEx on NAND will grow by 13% year-over-year, whereas expenditures on DRAM will increase by 34% YoY.

Microprocessor (MPUs) and microcontroller (MCUs) manufacturers, led by Intel, are on track to raise their CapEx to $23.5 billion this year, up 42% compared to 2020. IC Insights models sales of MPUs and MCUs in 2021 to hit $103.7 billion, up 14% from the previous year, and continue to grow at a compound annual growth rate (CAGR) of 7.1%through 2025, when their sales volume will reach $127.8 billion. Therefore, it is not surprising that companies are gearing up to meet demand for their chips in the coming years.

Intel alone expected to spend around $19 billion of CapEx money on expanding its factory network in 2021. While other suppliers of MPUs and MCUs have considerably lower CapEx budgets, they are also boosting their operations and are investing in things like dedicated packaging lines.

Most applications that use processors or highly integrated controllers also tend to use different logic devices as well as analog and other components. To that end, suppliers of logic and analog/other devices are also increasing their CapEx spending by 40% and 41% year-over-year respectively as demand for their products is growing rapidly without any signs of slowing down.

Related Reading:

- Texas To Get Multiple New Fabs as Samsung and TI to Spend $47 Billion on New Facilities

- GlobalFoundries To Spend Billions: Doubling Fab 8, Creating New Fab in NY

- GlobalFoundries To Build New 450K Wafer-per-Year Fab in Singapore

- Sales of Fab Tools Surge to Over $71 Billion in 2020

- TSMC to Spend $100B on Fabs and R&D Over Next Three Years: 2nm, Arizona Fab & More

- China's SMIC To Build a GigaFab for $8.87B: An Answer to the Shortages

- SMIC to Build a New 28nm Fab in Shenzhen: Production to Start in 2022

7 Comments

View All Comments

HyperText - Friday, December 17, 2021 - link

Great! Let's keep buying ASML shares!StevoLincolnite - Saturday, December 18, 2021 - link

Honestly... This is where Hindsight is annoying...But it feels like AMD missed a big opportunity by selling off it's fabs considering how big this pie is exploding.

DanD85 - Sunday, December 19, 2021 - link

What are you talking about? Spinning off global foundry is the best decision AMD has ever made. Don't you see how Intel has been struggling for the past 10 years? They still falling behind right now and have to count on TSMC for leading edge manufacturing. If it's anything, AMD should have spun off its foundry arm even sooner!meacupla - Monday, December 20, 2021 - link

Not only that, Gloflo is being sued by IBM for $2.5 billion, for gloflo's failure to deliver 10nm and 7nm fabricators.mode_13h - Monday, December 20, 2021 - link

You're ignoring what would've happened to AMD, if they'd continued to operate with their own fabs. It wouldn't have helped their financial situation, which was probably already on the brink of bankruptcy, in 2015 or so.Plus, you're conveniently glossing over how one of Zen 2's big advancements was switching from Glo Fo's 12 nm node to TSMC's 7 nm. Maybe Glo Fo wouldn't have cancelled their 7 nm under AMD's ownership, but it also could've played out like what happened with Intel's 10 nm node. Or, at the least, maybe it simply wouldn't have been competitive with TSMC's.

Oxford Guy - Wednesday, December 22, 2021 - link

Apple has clearly suffered greatly due to not owning a fab.sweetgoals - Tuesday, January 4, 2022 - link

So says Global Foundry guy? Who just barely went public and has been losing a ton of money. Last time I heard they were losing something like 800 million a year. What does he know?