The Business of Technology: AMD Q3 2007

by Ryan Smith on November 2, 2007 1:00 PM EST- Posted in

- Bulldozer

AMD By The Numbers

As always, we'll start this Business of Technology article with a look at AMD's stock price, a solid gauge of their overall health.

5 year stock history, courtesy of Yahoo! Finance

In spite of AMD's current situation, the stock has still done worse over the 5 year period, something not hard to imagine given the company's status of often hanging on by a thread. Their stock is still up almost three-fold compared to their lowest point prior to the launch of the K8. Going by their stock alone, AMD would appear to still have some breathing room should the fall further.

However as K8 sales set up AMD for a period of strong business growth and high stock prices, it has also set very high expectations for AMD that they have not been able to meet. The stock has fallen nearly 75% since its 5 year peak, and nearly 50% in the last year. The price drop represents both a dissatisfaction from Wall Street on AMD's future outlook, and a punishment for losing so much money over the last year.

How much has AMD lost, and how does that compare to their total revenue?

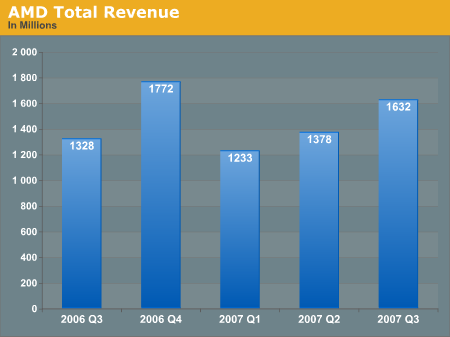

Because AMD acquired ATI in Q4 2006, we do not have completely comparable data for Q3 of 2006. The change in revenue between the two Q3s as a result is not solely revenue growth, but is rather a combination of that and the addition of ATI's products to AMD's business.

All told, the total revenue situation is actually good for AMD. In spite of the fierce competition with Intel and NVIDIA, their total revenue after removing their graphics revenue is still up a bit. Furthermore in this quarter they managed to beat Wall Street's rather pessimistic projections for revenue, thanks to overall processor sales that were above those expectations. AMD's price war with Intel has allowed them to keep their chips selling well (prices aside) while the Barcelona launch in September further boosted revenue.

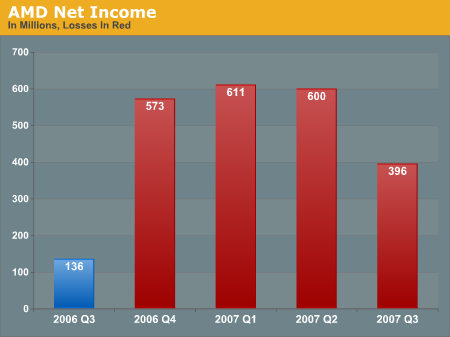

Profits are less rosy however. The higher revenue has offset what was expected to be worse losses in Q3, but it wasn't nearly enough to move AMD close to profitability. Since their dip began, AMD has lost over 2 billion dollars on revenues of 6 billion; or in other words spending about $4 for every $3 of revenue. It's sufficient to say that this isn't something AMD can keep up, but for now their losses are lessoning.

So what have they been losing so much money on? Contrary to popular belief, this isn't solely due to price wars with Intel and NVIDIA, which is very good news for the company. We'll take a look at the segment breakdown to explain why this is.

| Revenue/Net Income By Business Group (In Millions, Losses In Brackets) | ||||

| Q3 2007 | Q2 2007 | Q1 2007 | Q4 2006 | |

| Computing | 1283/(112) | 1098/(258) | 918/(321) | 1486/65 |

| Graphics | 252/(3) | 195/(50) | 197/(35) | 166/(27) |

| Consumer Electronics | 97/(3) | 85/(22) | 118/(4) | 120/20 |

| All Other | 0/(108) | 0/(127) | 0/(144) | 1/(587) |

| . | ||||

Overall AMD is losing money on all of its major businesses, but their consumer electronics and graphics divisions are losing comparatively little money (so little in fact that they may as well be break-even), it's the processor and "other" segments that are the real money losers. For the processor segment in particular, AMD is not losing any money directly from chip manufacturing in spite of the price war, it's only after additional costs such as R&D are factored in that the segment is losing money.

The segment eventually needs to pay for its R&D, but to be losing money now, on the eve of the rest of the K10 launch, isn't a bad place to be. Furthermore AMD has managed to improve its gross margin (the percentage of revenue after the cost of goods) on its product range from a particularly low 33% to a stronger 41% between Q2 and Q3. A low gross margin had been an important factor in contributing to the processor segment's losses, so improving it is the biggest step to digging that segment out of the red.

Next, when we take a look at the "other" segment we can begin to understand where AMD is really losing much of its money. "Other" isn't a segment of real products, but rather the segment where AMD categorizes all expenses that don't fall in to other segments; this includes acquisition expenses, stock compensation expenses, and profit sharing. As it turns out, most of the $108 million that was lost was due to the ATI acquisition, which AMD is still paying for. The costs of the acquisition have set AMD back by $256 million so far this year. But (and this is the good news) these costs will be coming to an end soon. The ATI acquisition hasn't been the only thing pulling AMD down, but it's also a temporary cost that will be coming to an end on its own.

There is one final money pit for AMD however that can't be buoyed up by any good news at the moment, and that's debt. AMD has never been in a position or a desire to be completely debt-free, but right now they're swimming in it. AMD needed to borrow money in the first place to be able to buy ATI, but this has been further compounded by their losses. AMD spent nearly $100 million just on interest charges in Q3, and this has been growing steadily since they started posting their latest series of losses.

To give you an idea of what kind of debt AMD is in, we have the assets & liability numbers from both Q3 2006 and Q3 2007. In Q3 2006, AMD held nearly $8.4 billion in total assets and held $689 million in actual debt among $3.4 billion in total liabilities. In Q3 2007 they held nearly $13 billion in total assets (mostly from the ATI acquisition) but held $8.8 billion in total liabilities, $5.3 billion of which is debt. The fact of the matter is that between absorbing ATI's debt and adding to their own, AMD has racked up nearly $5 billion in debt in the last year. It goes without saying that this is very, very bad.

In closing on the subject of business, there has been a lot of concern if AMD can stay solvent for much longer. Looking at the numbers, rumors of AMD's impending death are a bit exaggerated. Barring any outside influences such as their own acquisition, AMD still has time left, but that time depends on what their losses are like. If AMD curbs their losses (and we expect this to be the case as things like the ATI acquisition come to an end) we're looking at a lot of time - AMD will be sound well in to release of the Bulldozer core in the future. But if they really want to turn things around they need to bring their processor and graphics segments to profitability, which as we'll see in our discussion on their technology, is a tall order that can be filled, but will be a challenge to do so.

In the mean time we can't ignore the effect that the ATI acquisition has had on AMD. It's not the cause of all of their woes, but it is the cause of a lot of them. We hope for AMD's sake that they're right about the GPU and CPU merging, because this entire endeavor will have been a significant drain on the company if Fusion and its derivatives don't pan out like AMD wants them to.

27 Comments

View All Comments

loa - Friday, November 9, 2007 - link

What many people today fail to realize is that the single most important factor driving CPU performance increases is the manufacturing process. The manufacturing process is as most people know crucial for the clock-frequency and power consumption. The main function it has is that for every new process generation the transistor budget doubles, which gives opportunity for better performance. What I know AMD has always lagged behind Intel in process technology, typically 6 to 12 months, and thus beeing 6-12 months after in performance.Of course they can alleviate this if the microarchicture design is superior. Sometimes AMD:s microarchitecture is better, sometime Intels, but in the long run they are probably quite even. What decides who will win is then process technology. If AMD won't be able to out get new process technologies no later than Intel, they will in the long run, on average, also lag behind Intel in terms of performance.

So all this talk about platform and microarchitecture is important, but the real issue is the process technology.

yyrkoon - Saturday, November 3, 2007 - link

Last page, last paragraph. I think the word you're looking for is 'current'.

magreen - Saturday, November 3, 2007 - link

Wrong word? LOL. The whole article was so replete with spelling mistakes, grammatical errors and bad writing, I thout I was reading xbitlabs, not AT. Anand, please do something about this! It's the second article in a row!magreen - Saturday, November 3, 2007 - link

Thought... Typing on a blackberry and can't see what I'm typing!strikeback03 - Tuesday, November 6, 2007 - link

lol, so maybe they can make the same excuse.TA152H - Saturday, November 3, 2007 - link

The 8086 hasn't even been out for 30 years, how can AMD be building it for over 30 years? They were building it before Intel invented it??? If they can do that, surely they can survive little annoyances like financial losses.AMD is in a price war they are winning? Are you crazy? They are losing massive amounts of money, while Intel is making enormous profits. Who do you think can sustain the price war, the one losing money on a huge scale, or the one making it? I'll give you a hint, the company losing massive amounts of cash is not the one winning a price war. They are the big losers. Let me guess, Germany and Japan won WW II, right?

AMD has been competitive for a long, long time, not just recently. They did make clones, sort of, and were in fact behind by Intel by a generation most of the time. But fundamentally, the computer business was a lot different 20 years ago. You still have chips like the 8086 being released in new machines, even though it was already nearly 10 years old. That was a processor TWO generations behind the 386 (186 and 286 were designed at the same time, even though the 186 was released a little sooner). More than that, AMD's processors were considerably better than what Intel made, on a generational basis. For example, Intel stopped at 12.5 MHz for the 286, AMD went up to 16 (some say 20, but I have never seen one). The AMD 386 was much better; it ran at 40 MHz (Intel stopped at 33 MHz) and used much power than Intel offerings, and was an extremely successful processor. AMD went up to 133 MHz with the 486, Intel stopped at 100 MHz and didn't even want to sell them too much.

They were not competitive in terms of performance, but they were extremely competitive in overall value (particularly the later 386 versions), and many companies used them.

The K5 was a pure AMD design, but the initial version was something of a disaster for them, since they disappointed Compaq with the performance and time of release. Intel retaliated against Compaq too, so it seriously bruised AMD's reputation. The later K5s were not too bad, except in floating point, but they were usurped by the NexGen designed K6, which had somewhat less IPC but could run at considerably higher clock speeds. It was a competitive processor with the Pentium II and Pentium III, especially the K6-III which ran faster on integer apps clock normalized by a good bit. It was considerably smaller, and used MUCH less power than the Pentium III. So, it was clearly superior in some ways, although suffered from poor floating point, and lower clock speeds compared to the Pentium III. The problem was more the platform than the processor. There was simply no good chipset for the Super 7. The MVP3 sucked, and the Aladdin was miserable too. I still think they should scrap the Barcelona for the mobile, and update the K6 and use it. The K7 was a terribly inefficient chip, and the Barcelona is just two iteratives removed from that. The K6, by comparison, ran circles around the K7 in terms of performance per watt. It would seem a more natural starting spot for a design. But, AMD probably lacks the resources, so they keep putting out rubbish like the Turdion. An updated K6 would be so attractive in the mobile space.

Mana211 - Monday, November 5, 2007 - link

Would it be so hard to fact check before spewing idiocy?http://www.amd.com/us-en/Weblets/0,,7832_10554,00....">http://www.amd.com/us-en/Weblets/0,,7832_10554,00....

1969

AMD incorporates with $100,000; establishes headquarters in Sunnyvale, California

1970

AMD introduces its first proprietary device: the Am2501 logic counter

1972

AMD goes public

1979

AMD debuts on the New York Stock Exchange

Production begins in new AMD Austin manufacturing facility

1982

At IBM's request, AMD signs an agreement to serve as a second source to Intel for IBM PC microprocessors

1984

AMD is listed in "The 100 Best Companies to Work for in America"

Now if all you want to talk about is x86 then sure that has only been going on for 2007-1982=25 years, but ignoring the 13 years they were in business before x86 became important to them is just sticking your head in the sand.

Calin - Monday, November 5, 2007 - link

The K6-3 used to run with three levels of cache (two in the processor, just like the Pentium 3, AND one in the mainboard). The cache on mainboard was 512kB or 1MB (I have a Soyo mainboard with 1MB of cache, which would be second level cache with a K6-2 - as it is now - or third level cache on a K6-3).My mainboard uses some ETEQ chipset - which, strangely enough, is recognized as VIA if you installed the VIA 4-in-1 drivers.

One more thing - the K6-3 might have had better performance per watt, and better IPC than the K7 - but K6-3 (which is the part with lvl1 and lvl2 cache AND is the part to compare K7 against) was available in 400 and 450MHz versions - and not any faster. I have no idea how much could you have overclocked one, but in the end K7 reached more than 800MHz. Hmmm, I wonder if the performance of K7 at 800Mhz would be higher or lower than the performance of K6-3 at 450MHz.

And by the way, if Intel now is making 64-bit processors for laptops, AMD would be forced (feature to feature basis) to do the same, and only K8 was 64-bit.

Spartan Niner - Saturday, November 3, 2007 - link

"The rumors of my death have been greatly exaggerated"-AMD

Regs - Saturday, November 3, 2007 - link

Financial accountants, outside agents and firms, sales, marketing, etc...they all had this forecasted before AMD bought ATi years in advance with many of the "what if" variables calculated in every forecast.I hope everything is going as predicted over there at AMD, and hope they can swim in the squals for just a little longer.